Nitto Kohki (JP:6151): J-Net Beauty or Beast?

A Decent Compounder, Hoarding Cash to Infinity and Trading Below Liquidation Value

Company Overview

Nitto Kohki, founded in 1956 and headquartered in Tokyo, Japan, is a well-established Japanese manufacturer of components, tools and machines.

Nitto Kohki's products are used in the construction- and automotive industry, medical device manufacturing and high-tech engineering.

Its mainstay products are quick connecting couplings to join fluid pipes. Customers are mainly found in the field of semiconductors manufacturing and housing construction.

Products of the machine tool segment are mainly steel drilling machines and die machining tools to produce automobiles.

In the pumping systems segment, the company mainly offers linear motor driven pumps with a wide range of applications. Among others in medical equipment and for wastewater treatment systems.

In the segment door closer the company offers mechanic and automatic products for medical facilities, offices and transportation equipment.

The company has sales subsidiaries in the U.S, U.K, Germany, Shanghai and Australia.

General Valuation

Apart from price metrics in relation to book value, Nitto Kohki does not appear to be a deep value investment in the spirit of Graham and Dodd.

Stated EPS for FY ended March 2022 came in at 95 Yen, leading to an actual P/E ratio of 16.

The stated average EPS for the last 20 Years was 111 Yen, leading to an average P/E ratio of 14.

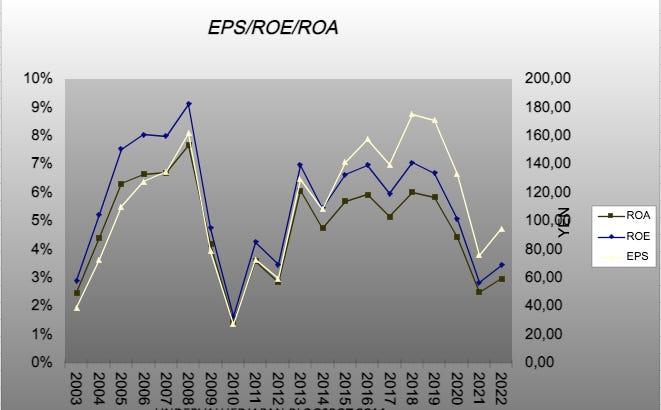

Depressed P/E ratios appear justifiable given that Nitto Kohki has been showing subpar (stated) rentability over an extended period of time. Over the last 20 years Return on Equity (ROE) has averaged out around 6%.

But P/E ratios and return metrics can be misleading. Especially in corporate Japan with its high cash balances, big investment portfolios and low financial gearing. They often do not reveal the attractive valuation of a company!

To adjust for the overly conservative financing of the company EV/ Ebit and EV/ Ebitda ratios are used.

The Enterprise Value (EV) of the company stands at 367 Mios. of Yen. If Nitto Kohki’s investment portfolio is excluded, which consists of highly liquid assets that are marked to market, the EV at current market price turns negative (-2’703 Mios. of Yen).

In the FY ended March 2022 Nitto Kohki reported an Ebit of 2’900 Mios. of Yen and Ebitda of 4’395 Mios. of Yen. Thus, EV/Ebit and EV/ Ebitda ratios are hovering around 0.

Overview of Operations

Nitto Kohki is operating in a cyclical segment of the economy. Sales suffered significantly during the Great Financial Crisis (GFC) and have never recovered to pre- crisis levels.

The company also was impacted by the Covid 19 crisis, but not as severe as during the GFC. Worth mentioning is that Nitto Kohkis operational business had been already under pressure pre- Covid.

The short- term impact of economic contractions on sales and operating margins can be severe. Nevertheless, in the last 20 Years the company has always been profitable.

Guidance for the FY ending March 2023 is 123 Yen, leading to an expected P/E ratio of 12.

Furthermore, average operating metrics over a full cycle are more than decent. The 20 Year average of stated operating and net- income margins are 15% and 9%.

Worth noting are the stable and high gross profit margins the company generates, fluctuating between 47- 52 %, independently of severe contractions in sales. The GFC serves as a good example. Although sales contracted by –40%, and operating and net income margins plummeted almost 14% and 8%, gross margins barely budged.

Due to overcapitalization of the balance sheet and the absence of financial gearing (see analysis of balance sheet), decent operating margins do not translate into decent return metrics. Average ROE over the last 20 Years was only 6%, barely matching Nitto Kohki’s estimated cost of capital.

It is interesting to note that the company exhibits a huge discrepancy between ROE and Return on Invested Capital (ROIC). When adjusting for the conservative financing of the company, ROIC has been outshining ROE by a significant margin since 2005.

Analysis of Cash Flow

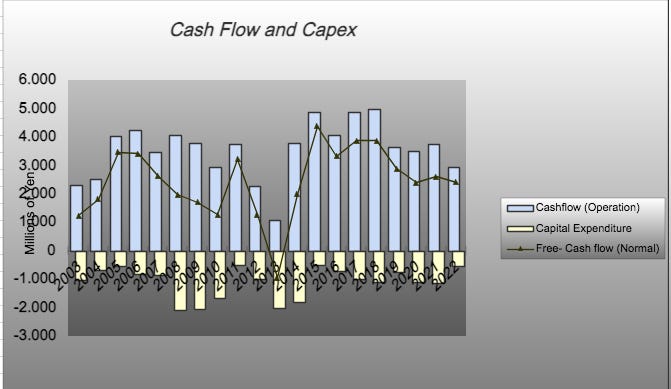

Generating significant and stable Operating Cash- flow (OCF) is Nitto Kohki’s strong suit.

More importantly, due to limited Capex requirement the company constantly churns out Free Cash- flow (FCF). In the last 20 years the company reported only one FY with negative FCF.1 At current market price the average FCF yield is roughly 8%.

The relatively high and stable nature of OCF and FCF over time allows inferences about a high quality of reported earnings. Average FCF per share more than equals EPS over a time frame of 20 years!

Interim Conclusion: A well-established Japanese manufacturing company that operates in a cyclical business segment. Scrutinizing operating and return metrics over an extended period, the company appears to be more resilient to fluctuations in the business cycle. The company’s ROIC is significantly higher than ROE.

Relatively high ROIC, high and stable gross margins in combination with high OCF and FCF over time pointing to a company with a certain degree of moat and/or competitive advantage.

Average FCF per share covering EPS points to extremely high quality of earnings.

Analysis of Balance Sheet

Nitto Kohki’s balance sheet is insanely overcapitalized. The equity ratio for FY 2022 stands at a staggering 87%.

Nitto Kohki is the poster child of a notorious Japanese cash hoarder.

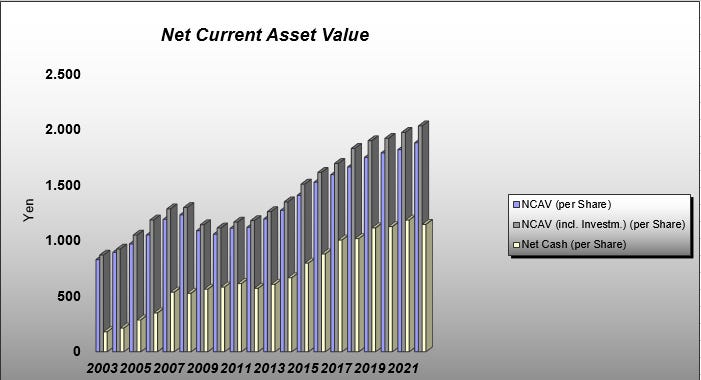

During the last 20 years cash holdings have almost quadrupled, from 410 Yen per share in 2003 to 1’560 Yen per share in 2022. Since 2014 the trend has even gained momentum. Due to absence of financial leverage Nitto Kohki’s cash holdings roughly equal its net- cash position. Including the investment portfolio roughly 90% of the market capitalization is covered by net- cash.

Apparently, the company's sole mission in corporate life is to increase its net- cash position to infinity!

Nitto Kohki’s Net Current Asset Value (NCAV) is roughly 2’000 Yen (incl. Investment portfolio). Thus, the company trades at a discount of 25%.

The stock even trades at a discount to its liquidation value (13%).

Trends in NCAV and liquidation value show a relentless uptrend over time.

Intrinsic Value/ Margin of Safety

In the last 20 years the discrepancy between share price and intrinsic value has never been more pronounced as of today.

The contraction in intrinsic value between 2020/2021 is solely attributable to an unnecessary dividend cut.

Based on a conservative valuation model incorporating the Graham growth value, discounted dividend value, earning- and asset power value the company is roughly 40% undervalued. Thus, it exhibits a minimum (theoretical) upside potential of roughly 70%.

Interim Conclusion: Company carries almost no financial debt on its balance sheet. The balance sheet is severely overcapitalized and bloated by cash. Overall business is cash generative. Company is trading below its liquidation value.

Company appears severely undervalued not only on an EV basis, but also on a valuation model based on Graham growth value, discounted dividend value, earning- and asset power value.

Analysis of Shareholder Returns

Generally, management targets a pay- out ratio to net income of roughly 40%. For FY 2022 the company paid a dividend of 40,50 Yen per share (=44% payout ratio).

Under the pretext of the Covid crisis, the company has unnecessarily cut the dividend from 51 Yen per share to 31 Yen.

The stated average payout ratio over the last 20 years was 38%. The real payout was slightly lower (34%).

Every now and then the company buys back its own shares. When it does, buybacks are executed at favorable terms for remaining shareholders. Since 2003 the company has bought back around 10% of outstanding shares. The last buyback program was initiated in 2020 and terminated in 2021. No shares have been retired.

Corporate Governance

The company has no takeover defense measure in place. But that is not necessary, given the founder, who died September 2020, and his family having a firm grip on the company, owning roughly the majority. Thus, engagement of a shareholder activist cannot be expected!

The company used to have a generous shareholder benefit program in place (“Yuutai Plan”). “Yuutai plans” are shareholder perks given only to Japanese retail investors. Those plans can yield a significant amount and are highly popular among individual Japanese investors.

The management abolished the plan in 2016/2017 citing concerns regarding equality to all shareholders. At the same time management increased the dividend significantly and bought back own shares. The action is laudable, and noteworthy, and stands in stark contrast to the increasing trend of Japanese companies introducing such shareholder benefit plans.

Still, the company remained a serious cash hoarder that shows severe disrespect to the interests of its minority shareholders. Primarily, by refusing them to participate appropriately in the company's performance in form of increased dividends and/ or share buybacks.

The severe dividend cut in FY 2021 serves a prime example. Given the insane overcapitalization of the balance sheet it was unnecessary and value destructive.

The best measure management could take to mend the severe undervaluation of the company in a timely manner is to adopt a liberal shareholder return policy based on dividend on equity (DOE). Basically, paying out a certain rate in relation to net assets. For example, a DOE policy of 5% would translate into 135 Yen per share, roughly 100% of average net income for an extended period of time.

Conclusion

Nitto Kohki is a well-established Japanese manufacturing company that operates in a cyclical business segment of the economy. Scrutinizing operating and return metrics over an extended period, the company appears to be more resilient to fluctuations in the business cycle.

The company is a serious cash hoarder. The current market capitalization is almost entirely backed by net- cash and liquid investments.

The company appears severely undervalued not only on an EV basis and NCAV, but also on a conservative valuation model based on Graham growth value, discounted dividend value, earning- and asset power value.

Adjusting for the insanely conservative financing of the company return metrics over a full business cycle appear decent.

Relatively high ROIC, high and stable gross margins in combination with high OCF and FCF over time pointing to a company with a certain degree of moat and/or competitive advantage.

The highly conservative pay- out policy and a management that neglects the interests of its minority shareholders is off-putting.

Given the insane overcapitalization a change in the pay- out policy, away from a policy based on net income towards one that is based on equity/ net assets, is long overdue.

Disclosure: Long Nitto Kohki (JP:6151)

Disclaimer: Undervaluedjapan uses information sources believed to be reliable and accurate. But this cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice.

Contraction of OCF in 2012 and 2013 was mainly attributable to increased working capital requirements.

Thanks very interesting. It looks like they will be building a new modern factory in 2025. This looks like it could be a material use of cash.

Great writeup! I'm leaning towards beauty, but the kind of beauty only deep value investors can appreciate. Thanks for bringing this to my radar.