Fukuda Denshi: Japanese Compounder In The Bargain Bin

Highly Profitable Japanese Medical Equipment Manufacturer Trading at 1,6 Times Liquidation Value

Business Overview

Fukuda Denshi (JP:6960) is a well- established and leading Japanese medical device manufacturer, having strength in equipment related to the cardiovascular system.

Founded in 1939, it developed Japan’s first electrocardiograph, The company offers a wide range of medical equipment products like defibrillators, patient monitoring, vascular screening -, ultrasound -, stress test - and respiratory systems. In addition, it provides therapeutic instruments for sleep apnea syndrome and sells AED (automated external defibrillators).

The Company holds high market share within Japan in several business segments that show a duopolistic/ oligopolistic market structure and a secular tailwind due to an aging population.

For a while, the growth engine has been renting medical equipment for home care, contributing significantly to the top and bottom line of Fukuda Denshi’s income statement.

Apart from being a R&D1 driven, high-quality medical equipment manufacturer, Fukuda’s moat, and the barrier of entry for any competitor, is to be found in its close- knit support/ service network, which consists of more than 190 sales offices across Japan

The absence of promotional behavior (limited IR), low trading volume of the stock and almost no analyst coverage has created a severe value dislocation in absolute and relative terms.

Basically, the company is a highly profitable, long- term compounder with solid growth prospects, trading at single digit P/E2 and P/OCF3 multiples and 1,6 times its liquidation value.

Drop of bitterness is Fukuda Denshi’s limited international presence (only 4% of sales are generated oversea), especially in light of Japan’s price cap on reimbursement for medical devices.

Analysis of Operation, Cash Flow and Balance Sheet

Analysis of Operation

Fukuda Denshi’s business is divided into four segments: Physiological diagnostic equipment; Patient monitoring equipment; Medical treatment equipment and Consumables and other products.

The company follows a growth strategy that emphasizes profitability, which is vindicated by a closer evaluation of key operating figures at segment levels.

Physiological diagnostic equipment (=22,3% of sales in 2022): Although Sales stagnated at around ¥ 26’000 M between 2012 and 2022, operating margins increased from 8-14%

Patient monitoring equipment (=9,8% of sales in 2022): Sales increased from ¥ 8’741 M in 2012 to ¥ 10’604 M in 2022, while operating margins increased from 7-19%

Medical treatment equipment (=41,3% of sales in 2022): Sales increased from ¥ 37’304 M in 2012 to ¥ 54’510 M in 2022, while operating margins increased from 12-21%

Consumables and other products (=26,6% of sales in 2022): Sales increased from ¥ 19’641 M in 2012 to ¥ 33’641 M in 2022, while operating margins increased from 9-15%

With a CAGR4 of 3 % p.a. in 22 Years Fukuda Denshi’s overall sales growth appears modest.

But modest sales growth has translated nicely into margin expansion and EPS5 growth, especially since the onset of Abenomics in 2012.

From 2000 to 2022 EPS increased by a CAGR of 7% p.a., from ¥ 111 to ¥ 535. Since 2012 the momentum accelerated significantly to 13% p.a.

Analysis of Cash- Flow

Fukuda Denshi generates abundant CFPS6. OCFPS7 increased from ¥ 175 Yen in 2000 to ¥ 765 in 2022, a CAGR of 7% p.a. Between 2012 and 2022 the CAGR was 12% p.a.

FCFPS8, or owner earnings, increased at 6 % p.a. over a period of 22 years, matching growth in EPS and OCFPS.

For several years, FCF readings have been depressed by significant Capex9 outlays.

For a manufacturer Fukuda Denshi can be regarded as a Capex light business. Depreciation charges in segments other than medical treatment equipment averaged roughly 2% over net sales between 2012 and 2022. An outlier is the segment medical treatment equipment (See Growth Strategy), which includes the rental business for home medical care. From 2012 to 2022 depreciation charges averaged 12% over net sales.

Thus, Capex should be treated as growth, rather than maintenance!

Growth Strategy: Home Care Business

Latest sine the establishment of “in-home care support centers”, as part of revisions to the medical treatment remuneration system implemented in 2006, the Japanese government has proactively promoted home care.

But out of necessity (in 2018 average hospital stay in Japan was three times longer than in the Netherlands) it keeps pushing harder. Compared to 2014 levels it is planning to reduce hospital beds by 10% in 2025, while, at the same time, it expects that 1m people will receive care at home in 2025—one-and-a-half times the total of 2018.

Fukuda Denshi has long centered its growth strategy around the home care business, providing rental services for oxygen concentrators, home-use mechanical ventilators and equipment used to treat sleep apnea syndrome.

In 2016 Fukuda Denshi took over OMRON Colin, a medical device manufacturer with strength in blood pressure monitors and test equipment, further expanding its product line- up in the home care business. It also signed a partnership with Omron Healthcare, which allows Fukuda Denshi to market its products via Omron’s global sales network.

Thus, the company is well positioned to keep profiting from the secular trend “Away from Hospital towards Home Care”.

Analysis of Balance Sheet

Fukuda Denshi exhibits a rock-solid balance sheet. Interest-bearing debt is negligible, and the shareholder equity ratio is in excess of 70%.

Since 2000 net assets and retained earnings have increased at a CAGR of 4,7% p.a. Growth in BPS was, with 6% p.a., slightly higher due to significant share buybacks conducted between 2009- 2013 (see Corporate Governance).

Fukuda Denshi’s asset composition is highly favorable, as the company carries little intangibles on its balance sheet and the majority of tangible assets are highly liquid.

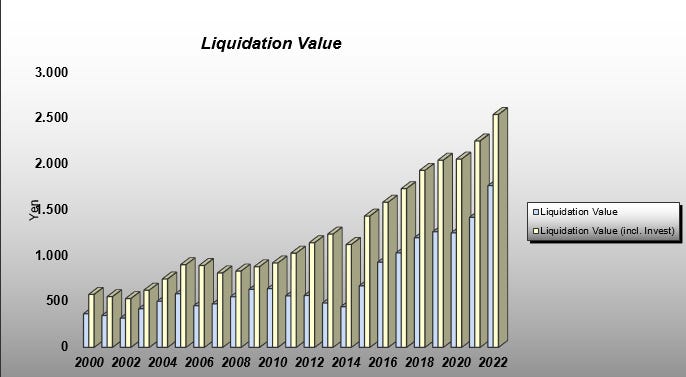

Fukuda Denshi’s liquidation value stands at roughly ¥1’800 per share. If the investment portfolio was included, which consists of marked to market investment securities and insurance funds, liquidation value would increase to ¥ 2’570 per share.

Hence, at the time of writing, investors are only willing to pay a premium of 60% to Fukuda Denshi’s liquidation value.

Valuation

General Valuation

Although, Fukuda Denshi exhibits high profit margins and, for a Japanese company, a decent ROE10 of 11%, it only trades at 8 times earnings, 5 times OCF and 0,8 Book Value.

Adjusting for little gearing, high cash balance and Fukuda Denshi’s investment portfolio, the value proposition becomes even more compelling.

ROIC11 (excl. all cash and investment holdings) for 2022 was 22% and the company is trading at an EV12/ Ebit13 multiple of 1,7. The FCF/ EV yield is 22%.

Relative Valuation

Fukuda Denshi’s main competitor within Japan is Nihon Kohden.

A relative valuation on the basis of EV to Ebit and Ebitda reveals a significant discount the market is applying to Fukuda Denshi. And this is for the company with the higher ROIC and higher FCF yield.

Valuation and Performance

Over 10 years the stock price has risen by a CAGR of 11,6 %, outperforming the TOPIX Index by roughly 70 %.

In 2012 the stock traded at a P/E ratio of 8 and a P/OCF ratio of 6, almost exactly where valuation stands at the time of writing. Thus, the stock performance has been fully backed by fundamentals. There was no expansion in the earnings and OCF multiple!

Analysis of Pay- Out Policy

Fukuda Denshi pays dividends biannuaully. The company targets a pay- out ratio of 30% over net- income and pays the dividend on a “hybrid basis”. That is payments have a fixed and a performance-related portion.

Up until 2004 the pay- out had been dismal. Between 2000 – 2006 Fukuda Denshi’s pay-out ratio fluctuated between 7 - 15%. Adjusting for a 1:2 stock split that took place in November 2022, the company has increased its dividend significantly, from ¥ 47,5 to ¥ 152,5, since 2011.

For the current Fiscal Year that ends in March 2023 the company guides for a total dividend of ¥ 140. At current stock price the dividend yield is 3,3%. The performance related portion of the year- end dividend has not been disclosed yet.

Corporate Governance

Corporate governance was an issue in the past. But most matters have been resolved and CG has been constantly improving.

2004-2005 Steel Partners, a foreign shareholder activist, had accumulated a significant amount of shares. By 2006 Steel Partners was Fukuda Denshi’s largest shareholder (with 14% of outstanding shares). Other major shareholders were Atomic Sankyo and Tokyo Enterprise, companies with strong relations to the founder and its family.

Steel Partners demanded a dividend increase from ¥ 40 to ¥ 140, which it deemed reasonable given Fukuda Denshi’s earning power.

In response, Fukuda Denshi doubled the dividend to ¥ 80 per share, but also pushed through a takeover defense measure at the AGM14, which still is in place.

Shortly after the GFC15 peaked, Steel Partners was forced to liquidate its position in Fukuda Denshi, which was no easy matter due to limited trading liquidity.

Fukuda Denshi took advantage and bought back Steel Partner’s block of shares in 2009/2010. It was the beginning of a significant buyback program that lasted until 2013, and in which Fukuda Denshi accumulated roughly 28% of outstanding shares at incredible favorable terms for remaining shareholders.

Following the percentage of outstanding shares, price paid (not split adjusted) and terms of the buybacks:

In 2009 the company bought back 4,2% of outstanding shares at ¥ 2’250. The price paid was roughly 20% above liquidation value (incl. Company's investment portfolio).

2010 it bought 6,5% at ¥ 2’500. The price paid equaled its NCAV16 (incl. Investment portfolio).

2011 the company bought 7% of outstanding shares at ¥ 2’110. The price paid equaled its liquidation value.

2012 it bought 3,7% of outstanding shares at ¥ 2’395. The price paid was slightly above liquidation value.

2013 the company bought back 8% at ¥ 3’750. The price paid was slightly above NCAV.

The last transaction was a tender offer, buying out Tokyo Enterprise.

The largest shareholder remaining was Atomic Sankyo, owning 16% of outstanding shares. The entity, which mainly produced and sold electrocardiogram recording paper, was 100% controlled by Fukuda Denshi’s founder and relatives, with Fukuda Denshi being the main customer via related party transaction

In 2015 Atomic Sankyo was made a wholly owned subsidiary of Fukuda Denshi by a share exchange, whereby Kotaro Fukuda’s holding in the company changed from direct and indirect to only direct. Through this transaction, Fukuda Denshi’s share count increased by roughly 1,5 Million Shares.

Apparently, Atomic Sankyo was taken over on favorable terms for Fukuda Denshi, as negative goodwill was booked on.

Kotaro Fukuda now owns 22% of the company via direct ownership. The treasury shares accumulated since 2009, roughly 20%, have not been retired.

Conclusion

Fukuda Denshi is a leading Japanese medical equipment manufacturer that is a long- term beneficiary of a rapidly aging population and structural changes in the delivery of healthcare to Japanese citizens.

Although the company has been growing only moderately over time, sales growth has translated into disproportionate rates of increase in profit margins, cash- flow and earnings. In addition, issues concerning the Corporate Governance have been resolved and the management appears to be increasingly aligned to the interest of minority shareholders.

Nevertheless, due to external factors, such as limited recognition and a general apathy towards Japanese equities from investor’s side, the company has been trading in deep value territory for an extended period of time.

Disclaimer:

Partners and myself hold a position in Fukuda Denshi (JP:6960)

Undervaluedjapan uses information sources believed to be reliable and accurate. But this cannot be guaranteed. The information contained in this publication are not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in this publications is that of the publisher and subject to change without notice.

Reference/ Source:

Summary Reports on Financial Results - Fukuda Denshi

Fukuda Denshi Announces that it Makes Atomic Sangyo its Wholly-owned Subsidiary

https://fukuda.com/news/press-releases-2009/

https://fukuda.com/news/10792/

https://fukuda.com/news/press-releases-2011/

https://fukuda.com/news/press-releases-2012/

https://www.fukuda.co.jp/press/2013/

Japan Panel Members Seek to Reduce Hospital Beds to Cut Costs (Nippon.com)

Japan tries to keep the elderly out of hospital (Economist.com)

Research and Development

Price to Earnings

Price to Operating Cash- Flow

Compounded Annual Growth Rate

Earnings per Share

Cash- Flow per Share

Operating Cash- Flow per Share

Free Cash- Flow per Share

Capital Expenditure

Return on Equity

Return on Invested Capital

Enterprise Value

Earning before Interest and Taxes

Annual General Meeting

Great Financial Crisis

Net Current Asset Value

Out of curiosity - have you tried contacting IR with these questions?

Could the extremely old management be a reason for the low valuation? CEO age 77, COO age 71 ... and other mangers also all above 70. A bit strange ... can such a management bring any innovation? Any thoughts on that issue?